The Client:

When Jabian began with this mortgage brokerage client, they had approximately 40 employees across four offices in Texas with aspirations for significant growth. Jabian interfaced with the client’s Founder and CEO, President, and Executive VP of Operations as the primary client stakeholders. These clients were in charge of setting the direction of the company and enabling the loan officers to close as many loans as possible.

The Challenge:

The client sought to adopt a system that would enable their loan officers to shift from a traditional loan officer model into greater business development to increase their loan volume capabilities. Previously, the client left each loan officer to learn the systems on their own. As a result, not all loan officers had adopted the system, and those who had lacked a standard, effective process to power growth. As a result, there was instability, missed deadlines, disappointed borrowers, and upset realtors whose businesses weren’t generating enough loan volume.

The Strategy:

Jabian met with each team member involved in the end-to-end loan process to learn the current loan team structures and their individual roles and responsibilities. Jabian developed a high-level process view to define a common process that could handle the 100+ loan scenarios encountered in the business. From here, Jabian was able to:

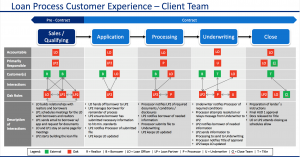

- Design future-state team structures, roles, and responsibilities

- Design the future-state process flow from contract to closing

- Illustrate handoff points between each member to enable seamless interchange for an excellent customer experience

- Apply the best-fit DISC personality profiles to determine potential hires for defined roles

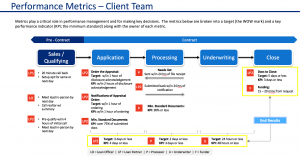

- Assign metrics and KPIs to promote best practice behaviors

Loan Process Customer Experience

Loan Process Performance Metrics

The Outcome:

As a result of our efforts, the client put the future-state structure and team model into a pilot with 12 loan officers participating. During the pilot, the client experience:

- Decrease in the loan process cycle time from 24 to 19 days

- 25 percent increase in processed loan count volume

- 20 percent improvement in the quality of the customer experience for sold loans